Our Process

We deliver custom investment strategies designed to meet our client’s financial objectives.

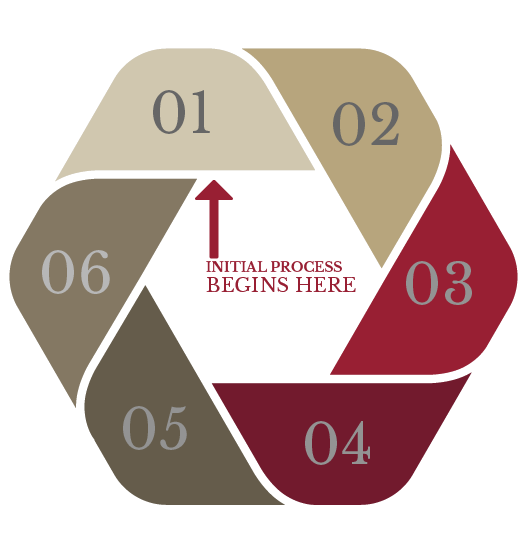

Investment Process

01

Review Current Circumstances, Clarify Objectives, Determine Appropriate Risk Tolerances.

02

Determine Appropriate Asset Allocation.

03

Customize Portfolio Investments to Meet Clients’ Specific Situations.

04

Purchase/Sell Securities and Implement Investment Plan.

05

Actively Monitor Investment Performance.

06

Re-balance/Fine-tune as Needed.

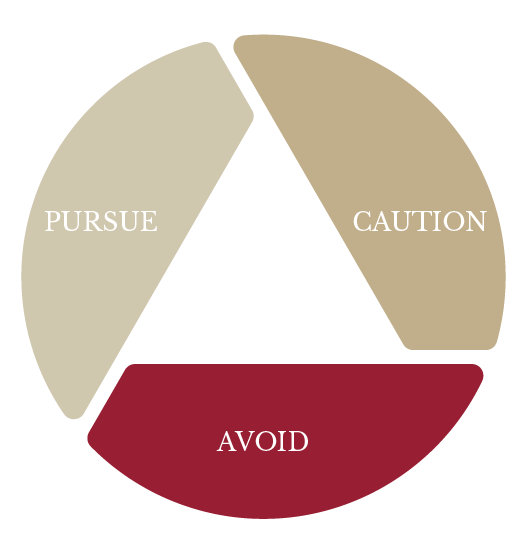

Investment Philosophy

Pursue

Appropriate Asset Allocation

Custom Portfolios

Broad Diversification

Tax Aware Investing

Ongoing Review

Long Term Perspective

Caution

Illiquid Assets

Short-Term Trading

Leverage and Derivatives

Avoid

Complexity

High Fees